SBI: How to withdraw money without a debit card at SBI ATM

SBI (State Bank of India) has come up with a new method for withdrawing cash through ATM (Automated Teller Machine). Through this method, you will not require an ATM Card for cash withdrawal. Yes, you read it right, you don’t need ATM card to withdraw cash, Isn’t that amazing.

In an era where digital

advancements are transforming the way we handle financial transactions, State

Bank of India (SBI) has embraced innovation to provide customers with

alternative methods of withdrawing money without the need for a physical ATM

card.

Whether you've misplaced your

card or prefer a cardless transaction, SBI offers user-friendly options to

access your funds securely.

In this article, we will explore

the hassle-free ways you can withdraw money without an ATM card from SBI.

In an era where digital

advancements are transforming the way we handle financial transactions, State

Bank of India (SBI) has embraced innovation to provide customers with

alternative methods of withdrawing money without the need for a physical ATM

card.

Whether you've misplaced your

card or prefer a cardless transaction, SBI offers user-friendly options to

access your funds securely.

In this article, we will explore

the hassle-free ways you can withdraw money without an ATM card from SBI.

Now the first question would arise in your mind, then how one can withdraw cash from ATM without an ATM Card? How is it even possible to withdraw money without an ATM card? Your query is absolutely justifiable because for so many years you might using ATM card to withdraw money from ATM on a day to day basis, and now you can withdraw money without ATM card sounds strange.

But this is true from now onwards things will change, you will not withdraw the cash the way you used to withdraw earlier, that is, you will not withdraw cash at ATM through ATM card if you want to. SBI has come up with a more easier way to withdraw money from ATM. Now let’s see what’s the new method which SBI has introduced.

Yono SBI App:

SBI's Yono (You Only Need One)

app is a revolutionary platform that integrates various banking services into a

single application. Take these easy steps to withdraw cash without an ATM card:

Download and install the Yono SBI

app from your preferred app store.

Enter your login information to

access your account.

Navigate to the 'Yono Cash'

section.

Generate a 6-digit Yono Cash PIN.

Enter the withdrawal amount and

the Yono Cash PIN at any SBI Yono Cashpoint to receive the cash without a

physical card.

Cardless Cash Withdrawal

Through SBI ATM:

SBI provides an option for

cardless cash withdrawal from its ATMs using the 'Yono Cash' feature. This is

how to make advantage of the service:

Log in to the Yono SBI app.

Generate a 6-digit Yono Cash PIN.

Initiate a cardless cash

withdrawal request through the app.

Visit any SBI ATM.

Select the 'Yono Cash' option on

the ATM screen.

Enter the Yono Cash PIN and the

transaction reference number received on your mobile to complete the

withdrawal.

Internet Banking:

SBI's internet banking platform

is another avenue through which you can withdraw money without an ATM card.

Follow these steps:

Open the SBI online banking

portal and log in.

Navigate to the 'E-Services' or

'Transfer Money' section.

Select the 'Cardless Cash

Withdrawal' option.

Enter the required details,

including the recipient's mobile number.

Share the transaction reference

number and PIN securely with the recipient.

The recipient can withdraw the

cash from an SBI ATM using the provided details.

SBI Quick – Instant Money

Transfer (IMT):

SBI Quick IMT is a service that

allows you to send money without the need for an ATM card. Follow these steps:

Register for the SBI Quick

service.

Generate an MMID (Mobile Money

Identifier) and MPIN.

Share the MMID and MPIN with the

recipient.

The recipient can visit an SBI

ATM, select the 'Mobile ATM' option, and withdraw money by entering the MMID,

mobile number, and the withdrawal amount.

Let's Understand with screenshots

To use this method One need to have a mobile phone either Android OS (Operating System) or iOS ( iPhone Operating System ).

First, you need to have or download the app called “YONO SBI” from your Google Play Store or through App Store and set up the app thereafter.

After setting up the YONO SBI app, open the app, enter the MPIN and press enter, after that, you will see “YONO cash” at the first page of the screen in the quick link click on it as shown in the below image.

OR

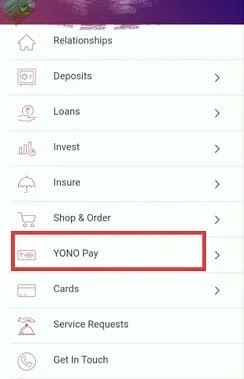

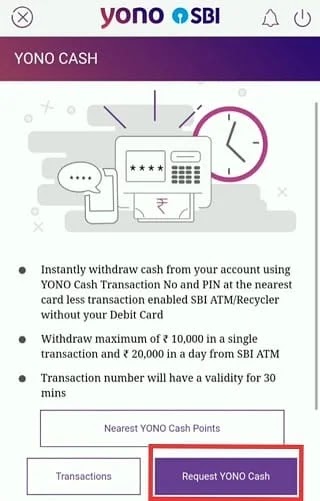

After clicking on “YONO cash” you will be taken to the page where you will see “Request YONO Cash” click on it as shown in the below image.

In the next page, you will see

“Account Number” and

“Amount Box”.

Simply put the amount details which you want to withdraw. Minimum Rs. 500 and multiple of Rs. 500 thereafter, that is Rs. 1000/-, Rs. 1,500/-, Rs. 2,000/- and so on but maximum Rs.10,000/- at a time.

For the understanding purpose, we will consider Rs.500.

After putting the amount details you will need to select on the “Next” button as shown in the below image.

Now you will be taken to the page name “Create PIN”. Where you will need to put 6 digit number PIN as per your choice, yes you read it correctly “as per your choice” it can be 123456 or 213456 or 987066 and so on anything which comprises 6 digit number.

For the understanding purpose, we will consider XXXXXX

After putting details of the PIN number, click on the “Next” button as shown in the below image

After clicking on the next button, you will be taken to the confirmation page, in the confirmation page you will need to first click at “I agree to the Terms and Conditions” and after that click on the “Confirm” button as shown in the below image.

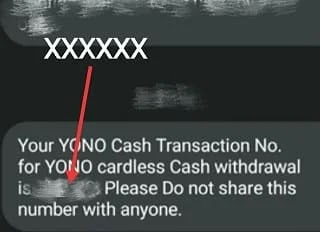

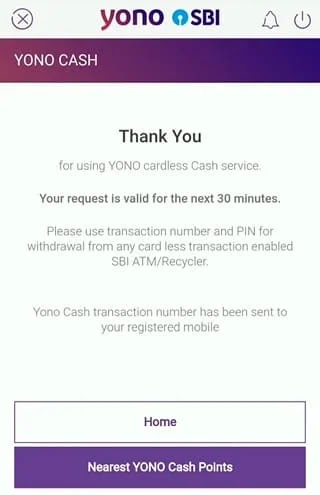

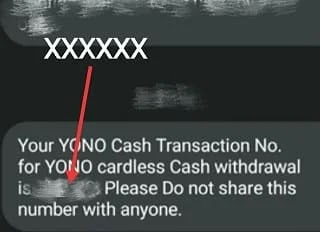

After clicking on the “Confirm” button, you will receive a “Transaction Number” through a message at your registered mobile number, which is registered with SBI bank. The transaction number will valid only upto 30 minutes. If you don’t withdraw money before 30 minutes, then you have to again generate the PIN and transaction number with the same process which has been mentioned above.

|

| Transaction Number received through message |

Now at the ATM machine, you will see in the front screen “YONO Cash” click or tap on it as shown in the below image.

After that, you need to enter the transaction number which you have received on your mobile phone and after that click on the “Confirm” button as shown in the below image.

After clicking on the confirm button, enter the amount details which you have already entered on your mobile phone, that is Rs.500/-

After this, click on “press if yes” as shown in the below image.

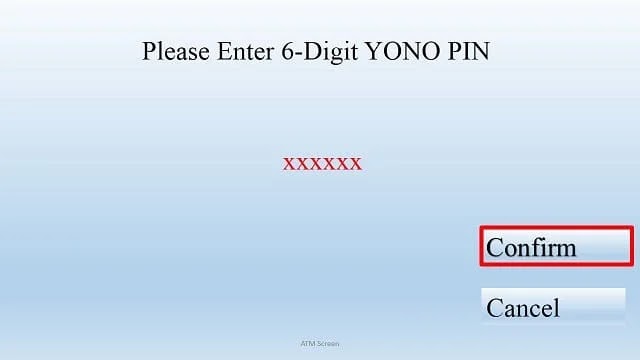

After clicking on “press if yes”, you will be taken to the page “please enter 6-digit YONO PIN”, enter the PIN which you have created through YONO app, that is XXXXXX and then click on “Confirm” button as shown in the below image.

After clicking on the confirm button you will receive Rs.500/- through the ATM machine.

In this way, you can withdraw your money without having an ATM card at SBI ATM. The service is currently available in 16,500 (Sixteen Thousand Five Hundred) SBI ATM, but in the next few months somewhere around 60,000 (Sixty Thousand) SBI ATM will be able to give this type of service.

One can withdraw Rs.10,000 at one go and the transaction is restricted to 2 per day, that means you can withdraw upto Rs.20,000/- per day through this service.

If you like this article please “Comment”, “Subscribe” and “Share”.

If you want more articles related to Latest Technology, Tech News, Latest Mobile, Apps etc. then stay tuned with us “sharingmythoughts”.

Disclaimer: We, as sharingmythoughts, cannot say that the information on this page is 100 percent correct.